5 Simple Steps to Save $10k in a Year

You’ve heard billionaires refer to savings as guaranteed routes to wealth?

Well, they are unarguably right, maybe 90% of the time. Let’s look at how you can save $10k in a year from your usual budget in the next one year without eroding your wellbeing or essential necessities. We’ll also touch on ways you can invest your $10k dollars to jumpstart your wealth creation…

Is It Possible To Save $10k in a Year?

With the right approach, yes it’s possible and you can do it if you stick to a well designed plan.

You don’t necessarily need to be a high income earner before you start saving for the future. The saving culture is one quality that takes time to imbue.

Imagine you turning down a well desired invitation to a pleasurable picnic because it would take a toll on your budget. If you have not firmly stamped your feet on a platter of the saving culture, turning down such an invitation may not come easy especially if you have the wherewithal to honor it. But it is by doing so that you can save a lot more than you’ve ever done on a similar budget.

The best time to learn the ropes is when the income is low. If you cannot keep a $10 bill aside when you have $100 at hand, it would be very unlikely that you will do so even when the money at hand grows to $500. It’s just a habit that flows naturally when developed. The point is, saving is a habit that develops overtime and this can only happen when you are intentional about it.

How To Save $10,000 In A Year

Whether your goal is to raise the rainy day fund or save for a future investment or whatever the aim may be, $10k is achievable in a year even on fairly low income. Let’s explore the many tips that will make you succeed in this journey.

Budget and Personal Finances

Start by reviewing your budget and personal finances. What you can save largely depends on what you earn. So you have to try and boost your income streams by either looking for a better paying job or choosing one that allows you to explore side hustles with the aim of sustaining multiple income sources.

When stable income streams are attained, the next task in line is to review your budget with the aim of substituting luxury. You need to clearly understand where your money normally goes and this review will avail you just that.

Make a close extermination of your bank and credit card’s 12 months history. Doing this will show you what you spend money on. Separate essential costs from nonessential expenses. Examples of essentials:

- Transportation

- Housing

- Utilities

- Food

- Healthcare

- Clothing

These essentials are what keep you going. They seem to constantly maintain their places in the lives of everyone and therefore, must not be ignored at any time.

However, if you think they are overly draining your funds, it’s time to adopt cheaper alternatives. For example, if your 5-mile office distance gulps as much as 10% of your budget on t-fare, consider using a bicycle instead of a car. 5 miles will take you a maximum of 30 minutes on bike. While helping you to cut down cost, this alternative also means that you are inadvertently doing yourself good in terms of physical exercise.

Next thing is to weed off unnecessary spending. The following are examples of nonessentials:

- Buying expensive gift items instead of cheaper ones

- Getting more groceries than you need and leaving some to expire

- Going for fanciful and expensive outfits instead of moderate and cheaper ones

- Holding on to unutilized subscriptions and paying for them

You will notice that all the above are directly linked to the basic essentials. The idea is not to scrap them but to adopt cheaper alternatives and throw the excess funds into savings.

Break Down How Much You Will Be Saving and the Frequency At Which That Would Be Done

To save $10,000 in a year on a low income is definitely not as insurmountable as it sounds. Breaking it down makes the process a lot easier to manage. I would advise that you plan your journey to save $10k in a year to go in tandem with your income inflow. If you are earning weekly, decide what percentage of your income that goes into savings as soon as your salary arrives. Do the same once a month if your salary comes monthly.

If you are earning monthly, you will need to cut out $833.33 from your monthly budget. If it’s further broken down to weekly savings, you would need to shave $208.33 from whatever you earn each week. And if you really want to break it down further, it’s $27.40 a day.

Of course, you understand that to effectively reach your goal of saving $10,000 in a year, these monies you cut from your budget must domicile in an account other than your usual accounts. Dedicating an account for this purpose will help to keep your spending urge at bay.

While choosing an account to save $10k in a year, consider choosing an account that yields interest. It’s okay to be choosy too because you also need one with a high risk tolerance. Here are some accounts to consider:

- High-yield Savings Account: this account leads among the low risk options. It equally comes with beautiful ‘interest’ packages.

- Money Market Account: money market account is similar to savings account in terms of interest yielding. What makes it standout is the easy accessibility of funds.

- Certificates of Deposit (CDs): this is another low-risk option that comes handy when searching for an ideal destination to save $10,000 in a year. Like a high-yield savings account, CDs offer awesome interest rates especially when you are committed to leaving your money in the account for an agreed period of time.

- Brokerage Accounts: this is another fantastic option when choosing a destination to save $10,000 in a year. The only downside is that brokerage accounts attract higher risk than other options. But, in the same manner, it also has higher potential to yield higher interest. This account gives you the leeway to invest in bonds, stock, mutual funds and other securities. If you choose to go this route, keep in mind that it comes with tax implications and there is no guaranteed returns.

RELATED: 365 Days Penny Challenge – How To Save Up To £700 In 52 Weeks

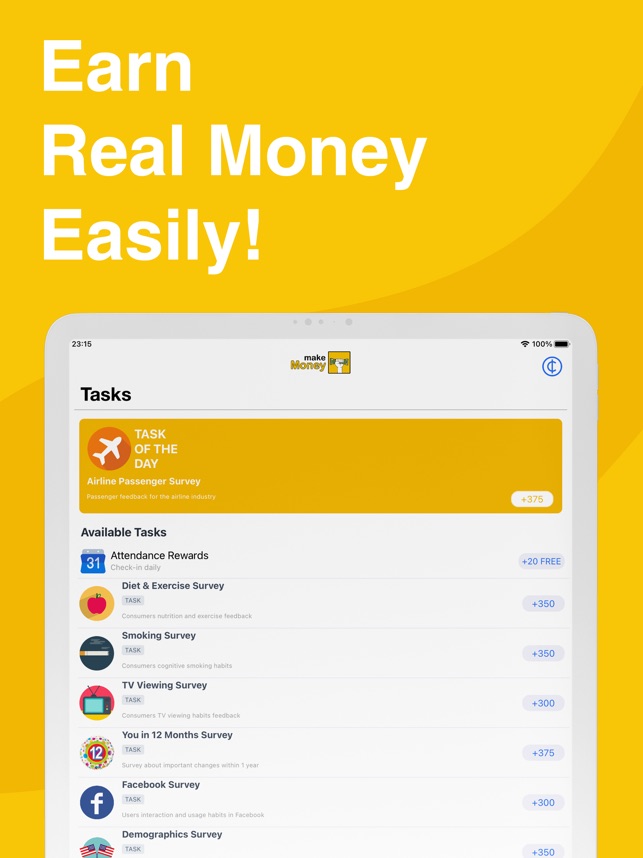

Earn Extra Money

Building up funds for financial independence can be addictive. It is often hard to start if you aren’t there already. But as soon as you start and get used to it, it is equally hard to stop. Looking back to realize that, somehow, you now have some amount of money somewhere to fall back on in times of financial crises comes with its own form of gratification. Like other habits, as the result continues to feel good, you will want to get more.

Consider trying your hands on side hustles. Doing this will help you to make more and probably save more.

RELATED: 15+ Super Lazy Ways To Make Money Online

Automate Your Savings

Automating an account to save $10k in a year will not add extra dough for you, but it will help you to stay focused and save as planned. You can have your paycheck split into different accounts. Whenever it’s pay time, a chunk of your salary can go directly into the new account. If you have a side hustle, you can choose to direct all of what comes from there into this account.

Explore Investment Options to Hasten the Growth of Your Savings

Since the targeted period is 12 months, I consider it improper to allow the garnered funds lay idly for so long a duration.

Why would that be allowed when the money can be put into use to earn more money?

We’ve shed light on a number of accounts that attract interest on deposits but there are other ways your saved funds can earn you more money before the targeted 12 months elapses.

As you continue to save more money week after week, your funds will soon start pilling up. You can choose to pull the money from its chosen destination and invest in one or two high-yielding short-term investment programs such as short-term Corporate bond funds.

The Bottom Line

To save $10k in a year is pretty doable, even on low income. While a-one-off attempt may not make you rich, a continuous repeat with a clear reinvestment outline surely will.

Like every other thing in life, being successful in this journey requires a great deal of determination. You have to define what you want and firmly resolve to get it at the end of the exercise.