How to Get a Palmpay POS Machine in 2024 (Easy Step-by-Step Guide)

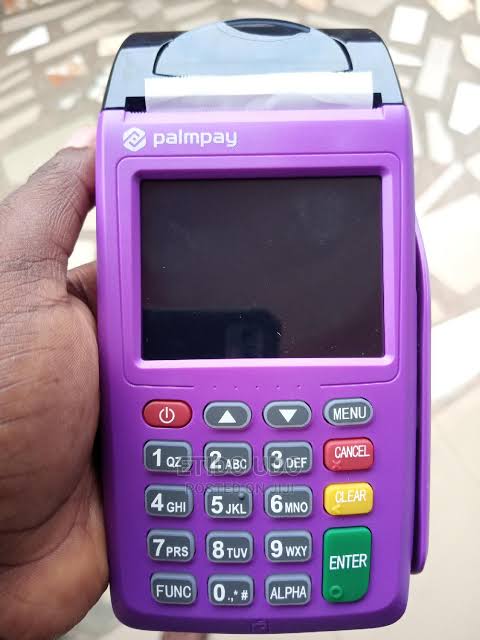

Ever dreamt of becoming your own boss? Maybe you’re a retailer with a shop brimming with amazing products, or perhaps you run a food stall with delicious treats everyone craves. No matter your business, accepting digital payments is key in today’s world. This is where a PalmPay POS machine comes in – a handy tool that lets your customers pay you instantly using their phones!

In this guide, we’ll walk you through everything you need to know on how to get a PalmPay POS machine, step-by-step. So, grab a cup of coffee, settle in, and get ready to turn your business dreams into reality!

Palmpay, a top-notch fintech company in Nigeria, is changing the game with its cutting-edge POS services. These devices make digital transactions smooth and hassle-free, providing perks like affordable fees, user-friendly interfaces, and top-notch customer assistance. Opting for Palmpay POS translates to choosing reliability and efficiency for your business transactions.

Things You Should Know Before You Apply for PalmPay POS

Thinking about becoming a PalmPay POS agent? Here’s what you need to know before you apply:

- Familiarity with the App: As an agent, you must be comfortable navigating the PalmPartner app and conducting various transactions. Make sure you can easily handle multiple transactions using the app’s interface.

- Suitable Physical Location: Choose a physical space for your POS that isn’t in close proximity to other PalmPay agents. This helps to ensure a wider coverage and customer base.

- Valid Identification: Have a valid identification document ready for the application process. This could include an international passport, voter’s card, National Identification Number (NIN), or driver’s license.

- Proof of Address: Provide a utility bill as proof of address. This could be a light bill, water bill, waste bill, rent receipt, or similar documents.

- Business Documentation (for Business Owners): If you’re a business owner applying for PalmPay POS, ensure you have valid documentation from the Corporate Affairs Commission (CAC).

- Valid Bank Account: Make sure you have a valid bank account number to link to your PalmPay POS for transactions.

By ensuring you have these essentials in place, you’ll be well-prepared to apply for and operate a PalmPay POS with ease.

How to Get A Palmpay Pos/How to Apply for a Palmpay POS

Getting started with Palmpay POS is simple. Just follow these easy steps:

- Download the PalmPay POS app (PalmPartner) from either the Play Store or the App Store, depending on your device.

- After the app is downloaded and installed, sign in using your PalmPay login details. If you’re new to PalmPay, you can create a new account during this step.

- Once logged in, navigate to your dashboard and locate the “PalmPay POS” option. Click on the “Apply Now” button to begin your application.

- You may be prompted to upgrade your account. If you haven’t done so already, complete the upgrade process using your BVN (Bank Verification Number) and proceed with the application.

- Complete the application form with the required details and submit it. Now, all you need to do is wait for a PalmPay customer care representative to review your application.

- The representative will contact you to ask some questions and verify your eligibility. If you meet the necessary criteria, your application will be approved.

- Once approved, you’ll need to pay a cautionary fee. After payment, your POS machine will be dispatched to you within a few days.

By following these straightforward steps, you’ll be on your way to receiving your Palmpay POS machine hassle-free.

Related Posts:

- 10 Sites That Pays $700 – $1500 For Remote Jobs This January

- FG: Get Collateral Free Loan For Your Business Here

- How to Make Money on TikTok in Nigeria 2024

Palmpay POS Fees and Charges

An enticing aspect of Palmpay POS is its competitive fee structure, which plays a vital role in business planning. Transparency is key, as there are no concealed costs, making it a favored option among Nigerian businesses.

Palmpay POS offers straightforward fees:

Withdrawal Charges: 0.5% of the transaction amount Deposit Charges: ₦10 flat fee

PalmPay POS Machine Features

Here are all the transactions you can perform on the PalmPay POS machine.

Is Palmpay pos caution fee refundable?

Absolutely! If you’ve decided that being a PalmPay merchant isn’t for you anymore, or if the POS business doesn’t align with your interests, you can return the POS machine provided by PalmPay. They’ll refund the caution fee you paid to get the machine in full, as long as the machine is returned undamaged.

Palmpay POS Security Features

At Palmpay, ensuring security is our utmost priority. We’ve equipped our POS machines with cutting-edge security features to safeguard both your transactions and your customers’ sensitive information. It’s crucial for you to understand these features thoroughly so that you can create a secure transaction environment for your customers.

Related:

- How to Get Moniepoint POS Machine, Become an Agent

- Best Virtual Dollar Cards for Payments Worldwide

-

How to start a POS business Profitably in Nigeria / First Money Agent

FAQ

How Much Does it Cost to Apply for a PalmPay POS Machine?

You can download the PalmPay app for free! However, if you want to get your hands on the PalmPay POS, there’s a small fee. It’s N20,000 for the regular POS and N30,000 for the Android device version.

Where Do I Download the PalmPay and PalmPartner App?

You can easily download PalmPay and PalmPartner using the links provided below. These apps are perfect for handling your transactions hassle-free.

Is PalmPay safe?

Absolutely! PalmPay has obtained a license from the Central Bank of Nigeria, which means it’s authorized to handle your deposits and conduct various financial transactions. In simple terms, PalmPay is a safe platform for your financial needs.