How To Borrow Money From PalmPay 2024: Borrow Easily – BVN or No BVN (Step-by-Step Guide)

Financial needs can arise unexpectedly worldwide, and a reliable solution to address them promptly is crucial. PalmPay, a popular financial platform, offers a hassle-free way for Nigerians to borrow money swiftly. Whether you have a BVN or not, this guide will walk you through the steps to secure a loan on PalmPay, ensuring you get the funds you need in less than 15 minutes.

How to Borrow Money from PalmPay without BVN in 2024

PalmPay understands the need for convenience, and borrowing money without the hassle of providing a BVN is now possible. Follow these easy steps to access quick loans:

- Download and Install the PalmPay App: Start by downloading the PalmPay app from your preferred app store. Install it on your device and proceed to create an account if you haven’t done so already.

- Verify Your Identity: While PalmPay allows borrowing without BVN, you’ll still need to verify your identity. The app will guide you through a simple identity verification process, ensuring a smooth borrowing experience.

- Explore Loan Options: Once your identity is verified, navigate to the loan section within the app. PalmPay offers various loan options, and you can choose the one that best suits your needs.

- Submit Loan Application: Complete the loan application by providing the necessary details. PalmPay employs a user-friendly interface, making the application process straightforward and efficient.

- Loan Approval and Disbursement: After submitting your application, PalmPay will promptly review and approve it. Once approved, the loan amount will be disbursed directly to your PalmPay account in minutes.

How Much Can You Borrow from PalmPay for the First Time

For first-time borrowers on PalmPay, the loan amount may vary based on several factors, including your creditworthiness and usage history on the platform. To ensure you maximize your borrowing potential, consider the following tips:

- Build a Positive Transaction History: Regularly use PalmPay for transactions to establish a positive history. This can increase your chances of securing a higher loan amount.

- Timely Repayment: Make sure to repay your loans on time. Timely repayments enhance your creditworthiness, making you eligible for more significant loan amounts in the future.

- Explore Additional Features: PalmPay may offer increased borrowing limits as you become familiar with the app’s features. Explore and utilize other services offered by PalmPay to enhance your borrowing capacity.

Also Read: how to borrow money from Opay in 2024

How to Get a Quick Loan from PalmPay

Getting a quick loan on PalmPay is a straightforward process. Follow these steps for a seamless borrowing experience:

- Open the PalmPay App: Launch the PalmPay app on your device and log in to your account.

- Select “Quick Loan”: Navigate to the loan section and choose the “Quick Loan” option.

- Enter Loan Amount: Specify the amount you wish to borrow. PalmPay will provide information on the associated interest rates and repayment terms.

- Submit Application: Complete the loan application by providing the necessary details and submit it for review.

- Receive Funds: Upon approval, the loan amount will be disbursed directly to your PalmPay account, ensuring quick access to the funds you need.

A Step-by-Step Guide on How to Borrow Money from PalmPay

Financial needs can emerge unexpectedly; having a reliable solution at your fingertips is invaluable. PalmPay, a leading financial platform, offers Nigerians a user-friendly way to access quick loans. This step-by-step guide will walk you through the process, ensuring you can easily borrow money and take control of your financial journey.

Step 1: Download and Sign Up

Begin your journey by downloading the PalmPay app from your preferred app store. Once installed, follow the intuitive sign-up process to create your account.

Step 2: Configure the Settings

Personalize your PalmPay experience by configuring the app settings. This step allows you to use the app to your preferences, ensuring you have the best borrowing experience.

Step 3: Add BVN and Other Details

While PalmPay offers the convenience of borrowing without a BVN, adding it can enhance your borrowing potential and streamline the approval process.

Step 4: Apply for a Loan

Go to the loan section within the app and check the various loan options available. Choose the one that suits your requirements and complete the loan application.

Step 5: Wait for Approval

After submitting your loan application, relax and wait for PalmPay to review and approve it. PalmPay understands the urgency of financial needs and aims to provide quick solutions.

Step 6: Withdraw and Use

Once your loan is approved, the funds will be disbursed directly to your PalmPay account. You can then withdraw the money and use it for your intended purposes

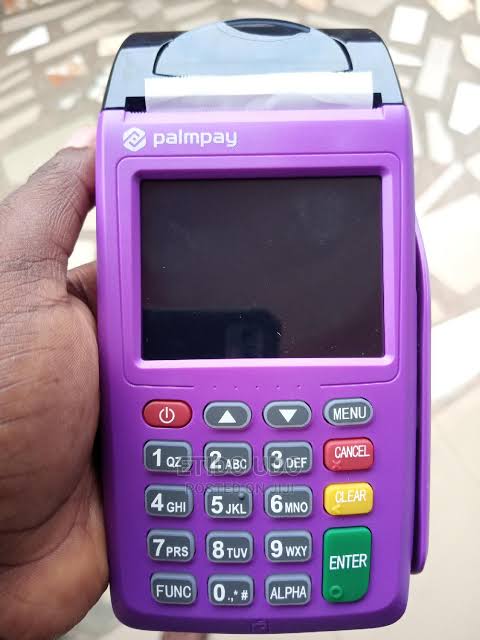

Also Read: How to get Palm Pay Pos

PalmPay Loan without BVN

I wondered if you could borrow money on PalmPay without providing a BVN. The answer is yes. While adding a BVN may enhance your borrowing experience, PalmPay recognizes the diversity of its user base and accommodates those who prefer not to provide a BVN.

Can You Borrow Money on PalmPay Without Paying Back?

It’s important to note that borrowing money comes with the responsibility of repayment. PalmPay encourages responsible borrowing and timely repayments. Failure to repay may impact your creditworthiness and eligibility for future loans.

Related: Best Loan Apps in Nigeria and their Interest Rate

How to Increase Your Maximum Loan

If you’re looking to increase your maximum loan amount on PalmPay, consider the following tips:

- Build a Positive Transaction History: Regularly use PalmPay for transactions to establish a positive history.

- Timely Repayment: Ensure prompt repayment of your loans to enhance your creditworthiness.

- Explore Additional Features: Utilize other services offered by PalmPay to increase your borrowing capacity.

How Long Does a PalmPay Loan Last?

The duration of a PalmPay loan varies based on the specific loan terms you choose. PalmPay provides clear information on repayment terms during the application process, allowing you to make informed decisions.

The Consequences of Defaulting on Your Loan: A Stern Wake-Up Call

Defaulting on a PalmPay loan is not a road you want to travel. The consequences include:

- Credit Score Impact: Defaulting adversely affects your credit score, impacting your ability to secure credit in the future.

- Accrued Interest and Fees: Unpaid loans accumulate interest and fees, compounding your financial burden.

- Legal Implications: Persistent default may lead to legal actions, severely threatening your financial standing.

How to Reach PalmPay: Swift Connections for Financial Queries

When you need to connect with PalmPay, don’t waste time. Solutions are at your fingertips:

- Customer Support: Reach out to PalmPay’s customer support for prompt assistance. Quick resolutions are just a call or message away.

- In-App Help Center: Explore the in-app help center for FAQs and common-issue guidance. Instant solutions await within the app.

PalmPay Loan FAQs on Borrowing Journey

1. How much can I borrow from PalmPay for the first time?

For first-time borrowers, the initial loan amount may vary based on factors like creditworthiness and usage history on the platform.

2. What is the interest rate for PalmPay loans?

PalmPay offers competitive and transparent interest rates. The specific rate may vary, so it’s crucial to review the terms during the loan application process for clarity.

3. Can I borrow airtime or data from PalmPay?

While PalmPay primarily focuses on providing monetary loans, it’s always good to explore the app for the latest features. As of now, PalmPay’s primary service is offering financial assistance.

4. How long does it take to get a loan from PalmPay?

PalmPay prides itself on efficiency. Once you’ve submitted your loan application, expect a swift response. In many cases, the approval process takes only minutes, ensuring you get access to funds promptly.

5. Can I repay my PalmPay loan before the due date?

PalmPay encourages responsible financial behavior. You can repay your loan before the due date without incurring any penalties.

6. What happens if I default on my PalmPay loan?

Defaulting on a PalmPay loan comes with consequences. It may negatively impact your credit score, accrue additional interest and fees, and potentially lead to legal actions. Communicating with PalmPay is crucial if you anticipate difficulties in meeting repayment obligations.

Conclusion

Recently, financial decisions have been pivotal; PalmPay stands out as a friendly and reliable ally for Nigerians. More ways to borrow on PalmPay open up opportunities for diverse financial needs.

Borrowing on PalmPay, remember that financial empowerment is about making informed choices. The application is not just about loans; it is about building a financially savvy community. Borrow responsibly and unlock the doors to your financial aspirations with PalmPay. PalmPay continues to be a beacon for Nigerians seeking loans and a pathway to greater financial well-being.